CRM for lending is an essential tool for lending institutions looking to streamline operations, enhance customer interactions, and drive growth. By implementing a CRM system, lenders can gain a comprehensive view of their customers, track loan applications, manage relationships, and automate tasks, resulting in improved efficiency, productivity, and customer satisfaction.

This guide will explore the key features, benefits, and best practices of CRM for lending, providing valuable insights and practical advice to help lenders leverage this technology to its full potential.

Understanding CRM for Lending

Customer relationship management (CRM) plays a crucial role in the lending industry. It helps lenders manage interactions with their customers, track loan applications, and improve overall customer satisfaction. A CRM system provides a centralized platform that streamlines the lending process, enhances communication, and enables lenders to build stronger relationships with their borrowers.

Benefits of Implementing a CRM System for Lenders

- Improved loan origination: CRM systems automate the loan application process, reducing errors and speeding up approvals.

- Enhanced customer service: CRM systems provide a single point of contact for customers, making it easier for them to resolve inquiries and track their loan status.

- Increased sales efficiency: CRM systems help lenders identify potential customers, track their progress through the sales pipeline, and close deals more effectively.

- Improved risk management: CRM systems can flag high-risk borrowers and help lenders make more informed decisions.

- Increased profitability: CRM systems can help lenders increase revenue by identifying cross-selling opportunities and improving customer retention.

Key Features of CRM for Lending

A comprehensive CRM system for lending operations should provide an array of essential features that streamline processes, enhance customer interactions, and improve overall efficiency.

These features include:

Lead Management

- Centralized lead capture and tracking

- Lead qualification and scoring

- Automated lead assignment and routing

Customer Relationship Management

- 360-degree customer profiles

- Personalized communication channels

- Automated customer segmentation

Loan Origination

- Integrated loan application processing

- Automated document generation and collection

- Real-time loan status tracking

Loan Servicing

- Automated payment processing

- Loan modification and restructuring

- Customer self-service portal

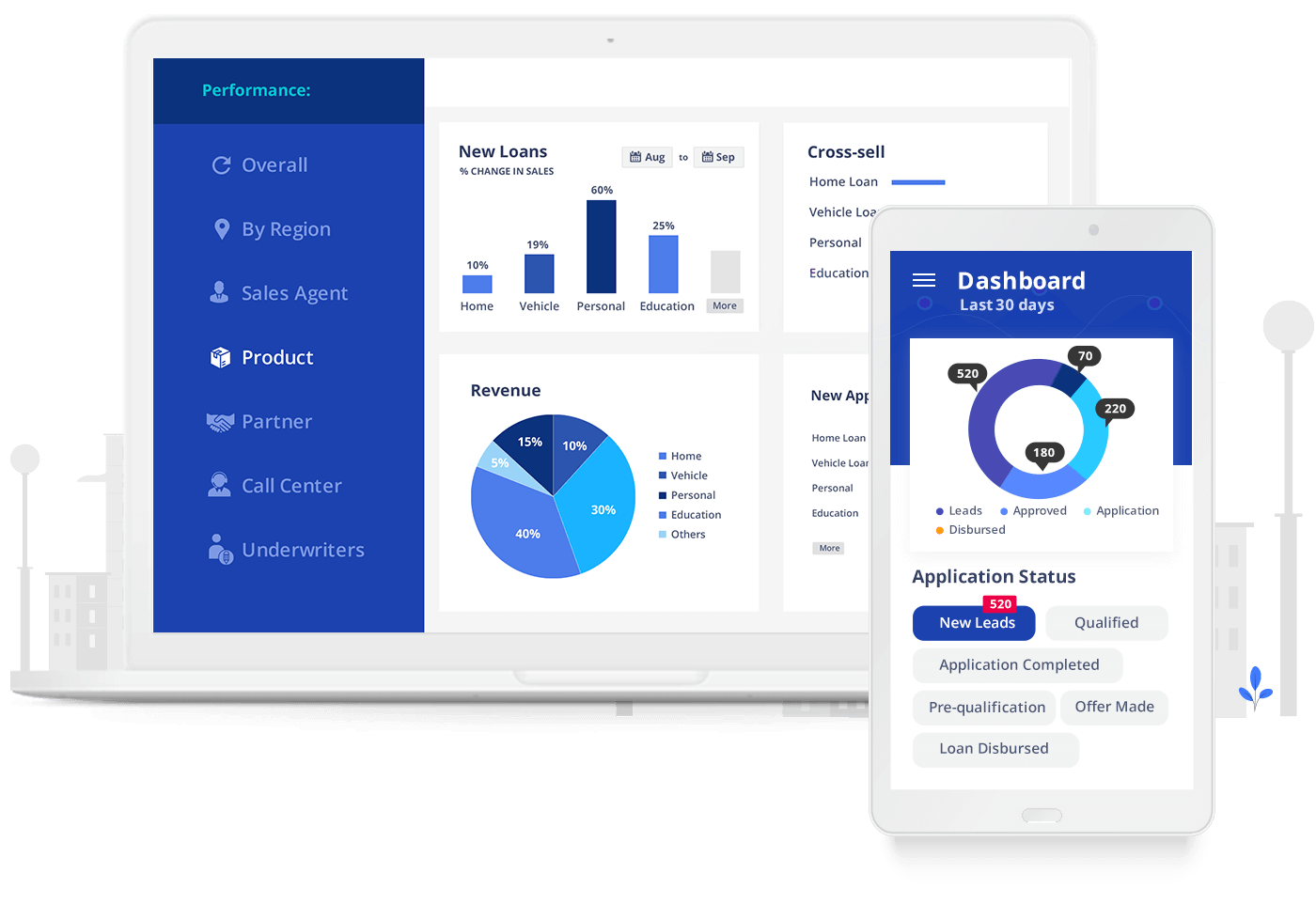

Reporting and Analytics

- Customized reporting dashboards

- Performance metrics tracking

- Data-driven insights for decision-making

Benefits of CRM for Lending

CRM systems provide significant advantages to lending organizations, enhancing efficiency, productivity, and customer satisfaction. These benefits can be quantified through tangible improvements in key metrics.

Improved Efficiency, Crm for lending

CRM systems streamline lending processes, reducing manual tasks and automating workflows. This leads to:

- Reduced loan processing times

- Increased loan volume without additional staff

- Lower operating costs

Enhanced Productivity

CRM systems provide real-time access to customer data, enabling loan officers to:

- Identify and target potential borrowers

- Cross-sell and up-sell products and services

- Provide personalized customer experiences

Increased Customer Satisfaction

CRM systems enable lenders to build stronger relationships with customers by:

- Providing personalized communication

- Resolving issues quickly and efficiently

- Building a customer-centric culture

Implementation and Best Practices

Implementing a CRM system for lending requires careful planning and execution. Lenders should follow these steps to ensure a successful implementation:

- Define clear goals and objectives:Determine the specific outcomes you want to achieve with the CRM system, such as improved customer service, increased sales, or better risk management.

- Choose the right CRM vendor:Research and select a vendor that offers a solution that meets your specific needs and budget. Consider factors such as functionality, scalability, and ease of use.

- Implement the CRM system:Work with the vendor to install and configure the CRM system. This may involve data migration, user training, and process changes.

- Monitor and evaluate performance:Regularly track key metrics to assess the effectiveness of the CRM system. Make adjustments as needed to optimize its performance.

To maximize the benefits of a CRM system for lending, lenders should adopt the following best practices:

Data Management

Maintaining accurate and up-to-date customer data is crucial. Lenders should establish clear data governance policies and processes to ensure data quality. This includes regular data cleansing and enrichment to remove duplicates, correct errors, and supplement customer profiles with additional information.

Process Automation

CRM systems can automate many repetitive tasks, such as lead generation, email marketing, and appointment scheduling. Lenders should identify opportunities to automate processes to improve efficiency and free up time for more strategic activities.

Customer Segmentation

Dividing customers into different segments based on their characteristics and needs allows lenders to tailor their marketing and sales efforts. Lenders can use CRM data to create customer segments based on factors such as loan type, credit score, and industry.

Cross-Selling and Up-Selling

CRM systems provide insights into customer preferences and behavior. Lenders can use this information to identify opportunities for cross-selling and up-selling additional products and services to existing customers.

Compliance and Risk Management

CRM systems can help lenders comply with regulatory requirements and manage risk. By tracking customer interactions and storing loan data, CRM systems provide a centralized repository of information that can be used for reporting and audits.

Case Studies and Success Stories

The successful implementation of CRM systems in lending institutions has resulted in significant benefits and positive outcomes. Here are a few notable case studies that showcase the challenges faced and the achievements attained.

One prominent example is the implementation of a CRM system by a large financial institution. The institution faced challenges in managing customer relationships effectively, leading to missed opportunities and reduced customer satisfaction. By implementing a CRM system, they streamlined their processes, gained a comprehensive view of customer interactions, and improved their ability to provide personalized services.

As a result, they witnessed a significant increase in customer retention and loan originations.

Another Success Story

Another successful implementation of a CRM system occurred in a mid-sized credit union. The credit union struggled with fragmented customer data and inefficient communication channels. By implementing a CRM system, they were able to consolidate customer information, automate processes, and improve collaboration among different departments.

This resulted in enhanced customer experiences, increased loan approvals, and a notable reduction in operating costs.

Trends and Future of CRM for Lending

The lending industry is constantly evolving, and CRM technology is evolving right alongside it. As the industry becomes more competitive, lenders are looking for ways to improve their customer relationships and streamline their operations. CRM can help lenders do both.

Here are some of the emerging trends in CRM technology for the lending industry:

- Artificial intelligence (AI)is being used to automate many tasks that were previously done manually. This can free up lenders to focus on more strategic initiatives.

- Machine learning (ML)is being used to personalize the customer experience. This can help lenders provide more relevant and timely offers to their customers.

- Data analyticsis being used to improve decision-making. This can help lenders make better decisions about who to lend to and how much to lend.

- Cloud-based CRMis becoming increasingly popular. This can help lenders access their CRM data from anywhere, at any time.

These are just a few of the emerging trends in CRM technology for the lending industry. As the industry continues to evolve, we can expect to see even more innovative and transformative uses of CRM.

Impact of CRM on Lending Operations

CRM can have a significant impact on lending operations. Here are some of the benefits that lenders can expect to see:

- Improved customer relationships: CRM can help lenders build stronger relationships with their customers by providing them with a personalized experience.

- Increased efficiency: CRM can help lenders automate many tasks, which can free up time for more strategic initiatives.

- Improved decision-making: CRM can help lenders make better decisions about who to lend to and how much to lend.

- Increased profitability: CRM can help lenders increase their profitability by helping them to close more loans and reduce their costs.

CRM is an essential tool for lenders who want to improve their customer relationships, streamline their operations, and increase their profitability.

Summary

In conclusion, CRM for lending is a powerful tool that can transform lending operations. By embracing its capabilities, lenders can gain a competitive edge, build stronger customer relationships, and achieve long-term success in an increasingly digital landscape.