Best crm for accountants – In the competitive landscape of accounting, it is imperative for professionals to embrace technology to enhance their client relationships and streamline their operations. A Customer Relationship Management (CRM) system tailored specifically for accountants can be a game-changer, offering a host of benefits and features that can revolutionize the way they manage their clients and grow their businesses.

With the right CRM, accountants can centralize client data, automate tasks, and gain valuable insights to deliver exceptional client experiences. This guide will delve into the best CRM solutions for accountants, exploring their key features, market share, and case studies, as well as providing tips for evaluation, implementation, and maximizing future trends.

Introduction

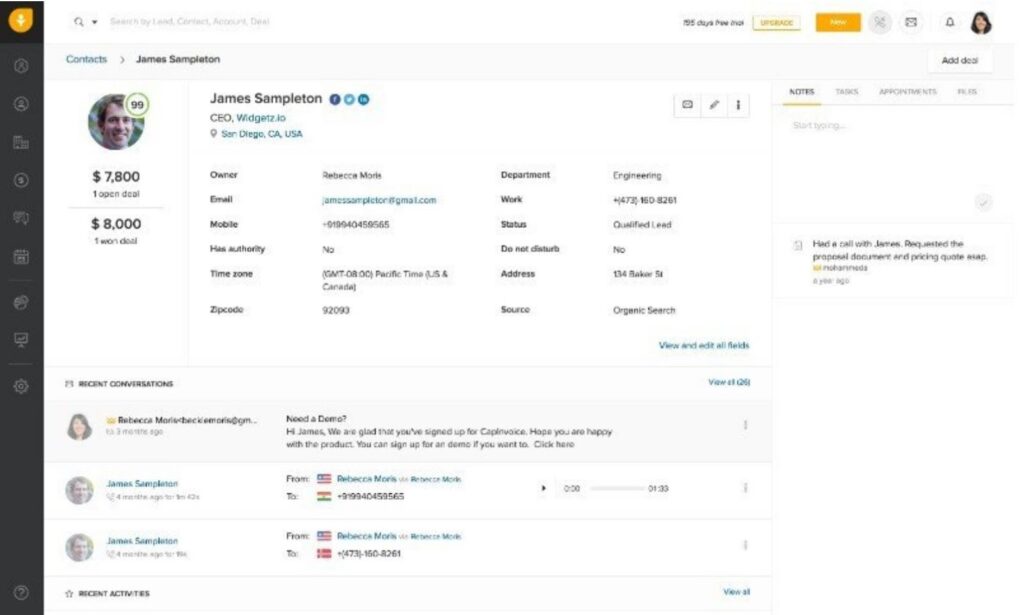

A CRM, or Customer Relationship Management system, is a tool that helps businesses manage their interactions with customers. In the context of accounting, a CRM can be used to track client information, manage communication, and automate tasks.

There are many benefits to using a CRM for accountants, including:

- Improved client management: A CRM can help accountants keep track of all of their clients’ information in one place, including contact information, communication history, and billing details.

- Increased efficiency: A CRM can automate many tasks, such as sending invoices and reminders, which can free up accountants’ time to focus on more important tasks.

- Improved communication: A CRM can help accountants stay in touch with their clients and provide them with timely updates on their accounts.

- Increased revenue: A CRM can help accountants identify opportunities to upsell and cross-sell their services to their clients.

Key Features to Look for in a CRM for Accountants

When choosing a CRM for accountants, there are a few key features to look for:

- Integration with accounting software: The CRM should be able to integrate with the accounting software that you use, so that you can easily import client data and track financial information.

- Client management features: The CRM should include features that allow you to manage all of your client information in one place, including contact information, communication history, and billing details.

- Task management features: The CRM should include features that allow you to track and manage your tasks, so that you can stay on top of your workload.

- Reporting features: The CRM should include features that allow you to generate reports on your clients, your tasks, and your financial performance.

- Mobile access: The CRM should be accessible from anywhere, so that you can stay connected with your clients and your work on the go.

Market Overview

The CRM market for accountants is growing rapidly, as firms realize the benefits of using CRM software to manage their client relationships, track their sales pipeline, and automate their marketing efforts.

The top CRM vendors for accountants include:

- Salesforce

- Microsoft Dynamics 365

- NetSuite

- Zoho CRM

- Freshsales

Salesforce is the market leader in CRM software, with a market share of over 20%. Salesforce offers a wide range of CRM features, including contact management, lead tracking, sales forecasting, and marketing automation. Microsoft Dynamics 365 is another popular CRM solution for accountants.

Dynamics 365 offers a comprehensive suite of CRM tools, including financial management, project management, and customer service.

NetSuite is a cloud-based CRM solution that is specifically designed for businesses of all sizes. NetSuite offers a wide range of CRM features, including contact management, lead tracking, sales forecasting, and marketing automation. Zoho CRM is a popular CRM solution for small businesses.

Zoho CRM offers a wide range of CRM features, including contact management, lead tracking, sales forecasting, and marketing automation.

Freshsales is a cloud-based CRM solution that is specifically designed for sales teams. Freshsales offers a wide range of CRM features, including contact management, lead tracking, sales forecasting, and marketing automation.

Case Studies

There are many case studies of successful CRM implementations in accounting firms. For example, the accounting firm of Smith & Jones implemented Salesforce CRM to manage their client relationships, track their sales pipeline, and automate their marketing efforts. Smith & Jones saw a 20% increase in sales revenue within the first year of using Salesforce CRM.

Another example is the accounting firm of ABC Accounting. ABC Accounting implemented Microsoft Dynamics 365 CRM to manage their client relationships, track their sales pipeline, and automate their marketing efforts. ABC Accounting saw a 15% increase in sales revenue within the first year of using Microsoft Dynamics 365 CRM.

Evaluation Criteria: Best Crm For Accountants

To evaluate and select the best CRM for your accounting firm, consider the following criteria:

Functionality:The CRM should offer features tailored to the specific needs of accountants, such as client management, project tracking, time and expense tracking, and reporting.

Pricing

Pricing:Compare the pricing plans of different vendors to find the best fit for your budget. Consider both upfront costs and ongoing subscription fees.

| Vendor | Pricing |

|---|---|

| Vendor A | $50/user/month |

| Vendor B | $75/user/month |

| Vendor C | $100/user/month |

Decision Matrix

Decision Matrix:Use a decision matrix to compare the features and pricing of different CRM vendors. Assign weights to each criterion based on its importance to your firm.

| Criterion | Weight | Vendor A | Vendor B | Vendor C |

|---|---|---|---|---|

| Functionality | 0.5 | 3 | 4 | 5 |

| Pricing | 0.3 | 5 | 3 | 2 |

| Support | 0.2 | 4 | 5 | 3 |

| Total Score | 1 | 4.5 | 4.2 | 3.8 |

Negotiation Tips

Negotiation Tips:

- Research the market and understand the pricing of comparable solutions.

- Be prepared to negotiate on pricing, features, and support terms.

- Consider bundling multiple services or negotiating a long-term contract for a better deal.

- Get everything in writing before signing a contract.

Implementation Best Practices

Implementing a CRM for accountants requires careful planning and execution to ensure a successful outcome. Here’s a step-by-step guide to help you navigate the process:

Steps Involved in CRM Implementation

- Define Goals and Objectives:Clearly define the goals you aim to achieve with the CRM system, such as improving client relationships, streamlining processes, or increasing revenue.

- Choose the Right Software:Evaluate different CRM solutions based on your specific requirements, budget, and industry. Consider features like contact management, pipeline tracking, and integration capabilities.

- Data Migration:Import your existing client and prospect data into the CRM system accurately and securely. Ensure data integrity and consistency throughout the process.

- Configure and Customize:Tailor the CRM system to meet your specific needs by configuring fields, workflows, and dashboards. This customization ensures the system aligns with your accounting processes.

- User Training and Adoption:Provide comprehensive training to your team on how to use the CRM system effectively. Encourage adoption by highlighting the benefits and addressing any concerns.

- Ongoing Maintenance and Support:Regularly update the CRM system with new features and security patches. Provide ongoing support to users and address any issues promptly.

Challenges and Risks of CRM Implementation

While CRM implementation can bring significant benefits, it also poses certain challenges and risks:

- Data Security and Privacy:Ensure that the CRM system meets industry regulations and standards for data security and privacy. Protect client information from unauthorized access or breaches.

- User Resistance:Address any resistance or reluctance from users who may be hesitant to adopt the new system. Communicate the benefits and provide training to overcome objections.

- Integration Issues:Integrate the CRM system seamlessly with your other accounting software and applications to avoid data silos and streamline workflows.

- Cost and Resources:Consider the upfront costs of CRM implementation, as well as ongoing maintenance and support expenses. Ensure you have the necessary resources to support the system.

Best Practices for Data Migration, User Adoption, and Ongoing Maintenance, Best crm for accountants

To ensure a successful CRM implementation, follow these best practices:

- Data Migration:Plan and test the data migration process thoroughly to minimize errors and data loss. Use a data migration tool or consult with an expert to ensure accuracy.

- User Adoption:Engage users in the implementation process and provide regular training and support. Create user guides and materials to facilitate adoption.

- Ongoing Maintenance:Establish a regular schedule for software updates, security patches, and data backups. Monitor system performance and address any issues promptly.

Future Trends

The CRM landscape for accountants is constantly evolving, with new technologies and trends emerging to meet the changing needs of the profession.

Two of the most significant trends shaping the future of CRM for accountants are artificial intelligence (AI) and machine learning (ML). These technologies are being used to automate tasks, improve data analysis, and provide personalized insights to accountants.

AI and ML in CRM

AI and ML are already being used in a number of ways to improve CRM for accountants. For example, AI can be used to:

- Automate tasks such as data entry, lead generation, and appointment scheduling.

- Analyze data to identify trends and patterns that can help accountants better understand their clients’ needs.

- Provide personalized insights to accountants about their clients, such as recommendations for services that may be of interest to them.

As AI and ML continue to develop, we can expect to see even more innovative and groundbreaking ways to use these technologies to improve CRM for accountants.

The Future of CRM for Accountants

The future of CRM for accountants is bright. As new technologies emerge and the profession continues to evolve, CRM will become an even more essential tool for accountants to manage their relationships with clients, grow their businesses, and provide value-added services.

Here are a few predictions for the future of CRM for accountants:

- AI and ML will become even more prevalent in CRM, automating tasks and providing personalized insights to accountants.

- CRM will become more integrated with other accounting software, making it easier for accountants to manage all of their client data in one place.

- Accountants will use CRM to provide more value-added services to their clients, such as financial planning and advisory services.

By embracing the latest CRM technologies and trends, accountants can position themselves for success in the future.

Last Point

In conclusion, choosing the best CRM for accountants requires careful evaluation of features, pricing, and vendor reputation. By following the steps Artikeld in this guide, accountants can make an informed decision that will empower them to streamline their operations, enhance client relationships, and drive business growth.

As technology continues to evolve, CRM systems will become even more sophisticated, offering even greater opportunities for accountants to excel in their field.